PARACRYP

PARAMETA TECHNOLOGY LLC

Forward

Shaping the Future of Privacy-First Decentralized Finance

In an era where asset tokenization, data sovereignty, and regulatory compliance are rewriting the rules of global finance, PARACRYP emerges as more than a protocol — it's a mission. At the intersection of technology, privacy, and trust, PARACRYP offers a transformative platform that redefines how value, ownership, and compliance converge on-chain.

Our journey invites collaboration: from developers and institutions to regulators and innovators. Together, we build infrastructure that safeguards privacy, unlocks tokenized economies, and fosters equitable access to capital and opportunity.

We present this document as a blueprint for a new paradigm — one where privacy is programmable, assets are borderless, and governance is truly by the people.

From Parameta ™ | © Paracryp

Prepared by Ancel Cott

www.paracryp.com

Table of Content

Executive Summary & Introduction

- Vision and Mission

- Foundational Principles

- Real World Assets Token (RWA—T 3.0)

The Problem and Opportunity

- Industry Challenges

- Market Opportunity

Architecture & Core Technologies

- Layered Design (P1 Privacy, I2 Interoperability, C3 Compliance)

- Technical Highlights

Use Cases

- Real Estate Tokenization

- Encrypted NFTs

- Privacy-Enabled Payments

- Smart Invoicing & B2B Contracts

- Supply Chain Finance

- Gaming & Metaverse

- Healthcare Data Exchange

Token Economics

- PARA Utility

- Inflation & Burn Model

- Staking & Incentives

Roadmap

- 2025–2028 Milestones

- Long-Term Vision

Governance, Community & Vision

- DAO Structure

- Community Initiatives

- Global Partnerships

Closing & Call to Action

- Why PARACRYP Matters Now

- Invitation to Collaborate

Contact & Resources

WHITEPAPER_3.0

08th April 2025

EXECUTIVE SUMMARY & INTRODUCTION

Executive Summary

PARACRYP represents a transformative leap in the decentralized finance ecosystem, designed to cater to the growing demand for secure, scalable, and privacy-preserving blockchain solutions. As tokenization continues to redefine asset ownership, PARACRYP enters the market as a modular blockchain protocol aimed at addressing the pressing limitations of current systems—namely, privacy, performance, regulatory integration, and technology development.

In today's fast-evolving digital economy, businesses and users alike seek more than just decentralization—they demand interoperability, compliance, and confidentiality. With real-world assets (RWAs) on the cusp of mass tokenization, PARACRYP provides a foundational infrastructure to facilitate seamless transfers, audit-ready smart contracts, and sustainable ecosystem governance called RWA—T 3.0. Its innovative architecture integrates zero-knowledge proofs, programmable privacy, multi-chain interoperability, and compliance-ready modules, all tied together through a community-driven governance model.

The PARACRYP ecosystem is powered by its native token, PARA, which serves multiple purposes: transaction fees, governance voting, node validator staking, access to premium features, and incentivization. Furthermore, PARA incorporates deflationary mechanisms to ensure long-term value creation for stakeholders. The platform's commitment to real-world use cases—including tokenized real estate, encrypted NFTs, supply chain finance, and more—underscores its utility beyond speculative assets

In the next five years, PARACRYP aims to achieve global traction through strategic collaborations, developer ecosystem expansion, and international compliance rollouts. It is not merely a blockchain—it is a bridge between privacy-first decentralization and institutional-grade finance all with RWA—T 3.0. This whitepaper outlines the challenges PARACRYP addresses, the solutions it proposes, the technologies it leverages, and the roadmap it follows to achieve long-term impact.

Introduction

Digital transformation has reached an inflection point where tokenization is no longer a futuristic concept but a rapidly unfolding reality. The rise of blockchain technology has introduced revolutionary changes in how assets are created, stored, and exchanged. Yet, this transformation has not come without challenges. Many existing blockchain solutions are either too slow, too costly, or too exposed for sensitive data transactions. Moreover, navigating compliance in an evolving regulatory landscape continues to hinder enterprise adoption.

PARACRYP was conceived to fill this gap. Built by a consortium of cryptographers, technologists, and regulatory experts, the platform technology is designed to support a broad range of use cases, from tokenizing physical properties to building enterprise-grade decentralized applications. Ecosystem of RWA—T 3.0 leverages a layered blockchain architecture with a privacy-first approach, enabling users to enjoy fast, and confidential transactions, all while remaining regulatory compliant. Beyond technical innovation, PARACRYP aims to cultivate a community of developers, users, and enterprises united by a common goal: redefining asset ownership and data privacy in the Web3 era. Through a suite of developer tools, educational initiatives, and grant programs, the platform is set to scale globally—fueling a decentralized economy where privacy, interoperability, and legal clarity are not afterthoughts, but foundational pillars.

THE PROBLEM AND OPPORTUNITY

Industry Challenges: What's Broken and Why It Matters Blockchain technology has opened the floodgates for decentralized applications and token-based economies, yet widespread adoption remains hampered by a host of challenges. The limitations of current blockchain ecosystems are not trivial. For institutional investors, enterprises, and even retail users, issues like data leakage, scalability bottlenecks, and legal ambiguity persist.

1. Data Privacy Gaps

Most public blockchains operate transparently by default, with all transactions visible on-chain. While this transparency is useful for audits and trustless verification, it's a significant drawback for individuals and businesses who require confidentiality. For instance, in 2021, a high-profile case involving a Fortune 500 company revealed how public transaction records exposed their payroll activities on Ethereum, prompting a strategic shift away from blockchain experimentation. Another real-world case involved a healthcare tech firm trialing smart contracts to handle patient billing. Their pilot revealed how visible transaction trails could inadvertently expose patient data correlations—ultimately breaching compliance requirements under HIPAA, halting further development.

2. Fragmented Infrastructure

The multichain future is already here, but interoperability between chains is patchy and often risky. Bridges, which allow token movement between blockchains, are frequently targeted by hackers. The Ronin Network (linked to Axie Infinity) suffered a $625M exploit in 2022 due to poor bridge security. This not only damaged user trust but set the ecosystem back by nearly a year as they scrambled to issue reimbursements.

This fragmentation also hinders enterprise integration. For example, a real estate firm in Dubai attempted to tokenize cross-border real estate assets using multiple blockchains but failed due to inconsistent bridge reliability and incompatible standards across Ethereum and Binance Smart Chain.

3. Compliance & Regulation

The lack of built-in compliance frameworks within most blockchain platforms forces developers and enterprises to create their own solutions, increasing overhead costs and reducing speed-to-market. When Binance was fined by the US CFTC in 2023 for noncompliance, it sent shockwaves through the industry, proving that failure to anticipate legal obligations can cost billions and damage reputations. In another instance, a financial services startup in Germany had to abandon its blockchain project after failing to meet BaFin's auditability requirements—mainly because the protocol lacked native support for transaction-level permissioning.

4. Network Congestion and High Gas Fees

Ethereum, while the most popular platform for smart contracts, continues to suffer from congestion during peak usage. During the 2021 NFT boom, average gas fees soared above $150 for simple transactions. This disproportionately affected smaller users and priced out innovative startups attempting to deploy low-cost dApps. Projects like CryptoKitties and Art Blocks experienced significant user attrition when congested network conditions caused delays and inflated costs, undermining user experience and trust.

The Macro Opportunity: A $16 Trillion Market Shift According to a 2023 report by Boston Consulting Group, tokenized real-world assets could exceed $16 trillion by 2030. This includes real estate, equities, commodities, bonds, and even carbon credits. The movement toward on-chain asset representation is not just a technical upgrade—it's an economic paradigm shift. Already, leading institutions like JPMorgan and HSBC have launched pilots in tokenized deposits and carbon credits. The Monetary Authority of Singapore's Project Guardian is pioneering RWA experimentation. Meanwhile, BlackRock is building onchain funds. Yet, the market lacks a single platform that elegantly combines privacy, compliance, scalability, and cross-chain operability.

PARACRYP ARCHITECTURE & CORE TECHNOLOGIES

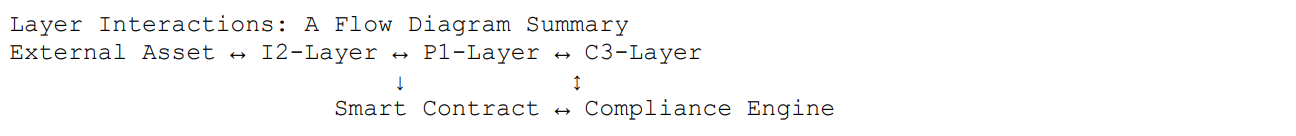

PARACRYP's design philosophy embraces modularity in its layer architecture. It's built on a three-layer framework that separates privacy, interoperability, and compliance into distinct operational planes. This ensures scalable development, easier audits, and a plug-and-play architecture for third-party applications.

1. P1-Layer: Privacy-First Smart Chain

The foundational layer of the PARACRYP ecosystem, the P1-Layer, is engineered with zk-SNARKs and Bulletproofs to ensure transaction confidentiality. Every transaction— whether it involves real-world assets or NFTs—conceals sender, receiver, and transaction amount unless the user explicitly authorizes visibility. This layer serves as the trustless ledger where all smart contracts are deployed and executed. Importantly, the P1-Layer acts as the finality layer: all data from other layers ultimately settles here with privacy guarantees.

2. I2-Layer: Interoperability Layer

This bridges between PARACRYP & external ecosystems. Using decentralized relayers and light clients, it enables cross-chain asset movements & data transfers. Wrapped assets originating from Ethereum, Solana, and even traditional financial APIs (via oracle integrations) are validated here before being mirrored on the P1-Layer. For example, when a real estate token is issued on Ethereum and moved to PARACRYP for private management, the I2-Layer verifies the asset's authenticity and syncs it with a private instance on the P1-Layer. This interaction ensures that external assets are treated with the same privacy and compliance policies native to PARACRYP.

3. C3-Layer: Compliance Module

C3 is PARACRYP's gatekeeper for regulatory fidelity. It houses the KYC/AML engines, on-chain identity issuance protocols, and permissioned transaction filters. Whenever a transaction or contract is triggered, the P1-layer first queries the C3-layer to validate whether the initiator is compliant and authorized. Smart contracts can be written with embedded compliance rules (e.g., whitelist-based token access). Identity providers and regulatory partners have API-level access to C3, enabling them to audit or update compliance statuses in near real-time without accessing private user data—thanks to zero-knowledge proofs.

- Assets or data enter via I2

- P1 handles transaction logic & privacy

- C3 ensures the transaction complies with jurisdictional and policy rules

Example Workflow: Tokenized Property Transfer

- - User A wants to transfer ownership of a tokenized apartment to User B.

- - The transaction is signed on the P1-Layer, encrypting both identity and asset details.

- - The C3-Layer validates both users' KYC status and ensures no regional embargoes apply.

- - If the token originated on Ethereum, the I2-Layer ensures bidirectional synchronization of ownership status.

Performance Highlights

- - TPS (Transactions Per Second): 10,000+ with horizontal sharding support

- - Finality Time: Sub-2 seconds (achieved through validator rotation and aggregated BLS signatures)

- - Data Availability: Validium and zkRollup support allow massive data throughput without overloading Layer 1.

This layered system not only separates concerns for security & auditability but also supports composability—third-party developers can build atop each layer independently while benefiting from the trust-minimized guarantees of entire stack.

USE CASES

1. Real Estate Tokenization or RWA—T 3.0

RWA—T 3.0 remains one of the most promising and transformative applications of blockchain technology. PARACRYP facilitates seamless tokenization of commercial and residential properties, enabling fractional ownership, automated compliance, and rent-based dividend distribution. By embedding rental agreements, tax conditions, and ownership rights into smart contracts, PARACRYP transforms illiquid real estate assets into fluid, tradable financial products.

Example: A high-rise property in Dubai's Business Bay was tokenized and made available to over 1,000 investors globally through PARACRYP's RWA suite. Tokenized ownership allowed investors to trade their shares on a regulated secondary market while receiving quarterly dividend payouts automated via smart contracts.

2. Encrypted NFTs for Digital Art, IP, and Media Distribution

Artists and content creators can mint NFTs with metadata encrypted using zeroknowledge proofs. Only verified owners have the decryption key to view highresolution art files, scripts, or early-access content. PARACRYP supports DRM mechanisms that embed legal rights and royalties directly into the NFT. Real-world Application: A media production company launched a pilot on PARACRYP to distribute encrypted film screeners to early reviewers. Only approved NFT holders with KYC-verified identities were able to decrypt and access the content, drastically reducing piracy.

3. Privacy-Enabled Payments for Freelancers, NGOs, and Contractors

Many industries require discreet payment methods, especially for professionals working in high-risk regions. PARACRYP enables privacy-preserving peer-to-peer transactions while maintaining compliance with AML regulations through zeroknowledge identity proofs.

Case Study: A decentralized humanitarian aid organization used PARACRYP to disburse payroll to medical professionals across war-affected regions. The payments were recorded on-chain for transparency but masked via zkSNARKs to protect identities.

4. B2B Contract Automation and Smart Invoicing

Enterprises often deal with multiple counterparties, requiring robust mechanisms for transparent yet confidential settlement. PARACRYP's programmable smart contracts allow automated payments, milestone tracking, and escrow resolution without exposing sensitive business logic. Pilot Scenario: A multinational logistics firm integrated PARACRYP with its ERP systems to tokenize shipment invoices. Each invoice was linked to GPS-based milestones and IoT sensors. Funds were auto-released when goods reached customs clearance points.

5. Supply Chain & Trade Finance

Supply chain participants can digitize documents like Bills of Lading and Certificates of Origin on PARACRYP. Combined with geolocation tracking and zeroknowledge attestations, financing can be disbursed at specific logistics stages. Example: A partnership with a Southeast Asian textile cooperative enabled manufacturers to tokenize export orders. Banks granted real-time working capital when customs tokens were verified on PARACRYP's privacy layer, enabling faster turnaround and reduced lending risk.

6. Gaming & Metaverse Economies

In the world of Web3 gaming, digital items, avatars, and currencies require secure ownership and transfer. However, exposing player wallet histories can enable cheating or targeted attacks. PARACRYP's NFT infrastructure supports encrypted asset metadata and anonymous trade mechanisms.

Example Integration: A fantasy RPG platform uses PARACRYP to issue rare in-game collectibles as private NFTs. These assets are tradable in a zero-knowledge marketplace, maintaining fairness and data protection.

7. Healthcare Data Exchange and Consent Management

Hospitals and clinics can issue encrypted medical records that patients control. Consent can be tokenized, ensuring traceable and revocable access. This aligns with GDPR and HIPAA, enabling patient-centric data sharing.

Hypothetical Deployment: A healthcare consortium in the EU uses PARACRYP to tokenize diagnostic data, granting insurance providers conditional access. Access logs are encrypted and verifiable but hidden from public view.

TOKEN ECONOMICS

Introduction to PARA Tokenomics

PARA is the native utility and governance token of the PARACRYP ecosystem. Designed to facilitate seamless participation in the network, PARA serves as the economic backbone of the protocol. From incentivizing validators to accessing privacy modules and facilitating compliance-driven operations, PARA fuels every activity within the ecosystem.

Tokenomics in PARACRYP is not just a functional necessity—it is a carefully modeled framework engineered for long-term sustainability, equitable distribution, and growth alignment with ecosystem expansion. Every economic parameter—from inflation rates to staking incentives and burn mechanisms—is structured to maintain network health, support development, and resist speculative volatility.

Token Utility Model

1. Transaction Settlement Layer:

- PARA is the default currency for transaction fees.

- Dynamic gas pricing adjusts based on network demand.

- Discounts are offered to high-volume enterprise users or stakers.

2. Governance Participation:

- Each PARA token represents one voting unit.

- Quadratic voting for community grants, upgrades, and DAO fund allocations.

- Special staking pools allow long-term holders to access elevated proposal rights.

3. Validator & Node Incentivization:

- Validators secure the network and are rewarded in PARA.

- Node uptime, performance benchmarks, and data availability proofs are scored.

- Reward curves favor early validators to promote decentralization.

4. Privacy and Compliance Features:

- Users stake PARA to access advanced ZK features, encrypted NFT layers, or compliance APIs

- Enterprises unlock tiered compliance support via PARA subscriptions.

5. Ecosystem Service Fees:

- dApps and DeFi platforms built on PARACRYP use PARA for contract deployment, API consumption, and token issuance.

- Token burning from platform usage aligns demand with network value.

Inflation Management & Sustainability

1. Controlled Inflation Curve:

- Starting annual inflation at 8%, decreasing by 1.5% annually until 1.5% floor is reached.

- Governance can modify parameters via DAO.

2. Token Burn Events:

- 1% of all transaction fees are automatically burned.

- Smart contract deployment fees include an upfront burn component.

- PARA from DAO ecosystem slush funds can be removed from circulation upon community vote.

3. Long-Term Lockups:

- Validators require 24–36 month staking periods.

- Developers receiving grants must lock 50% of PARA until product launch

- Community contributors who receive retroactive funding are subject to DAO-defined vesting.

4. Elastic Staking Rewards:

- Staking APR ranges between 4%–15% based on network participation.

- Dynamic validator incentive pool adjusts every epoch to maintain competitiveness and decentralization.

Scenario 1: Network Expansion Phase

- 1M active monthly users

- Average of 2.5M transactions per day

- 1.5M PARA burned annually from tx fees

- Treasury value increases as more PARA is transacted and reabsorbed via buybacks

Scenario 2: Validator Saturation Phase

- 1,000+ validator nodes active

- High competition drives up performance metrics

- PARA staking rate exceeds 65%, causing scarcity

- DAO considers introducing new staking tiers with capped rewards

Scenario 3: Ecosystem Maturity

- PARA becomes collateral on external DeFi protocols

- PARA used to purchase insurance vault coverage and compliance bonds

- Multiple off-chain PARA payment rails integrated for business adoption

Stability Mechanisms

1. Price Volatility Controls

- Market-based buyback programs triggered during sharp corrections

- PARA-denominated stable pools for DeFi activity

2. Insurance Vaults

- DAO-controlled coverage for staking slashing or smart contract failures

- Liquidity provider incentives in PARA with coverage-linked bonuses

3. PARA Reserve DAO

- Separate governance fund (5% of total supply) maintained for macro stabilization

- Triggered only by multi-sig + quadratic vote approval

By embedding economic safety nets, flexible rewards, and sustainable issuance mechanisms, the PARA token economy ensures that PARACRYP not only supports high throughput and enterprise-grade infrastructure but does so in a resilient, community-aligned, and regulatory-conscious manner.

ROADMAP

Development Phases and Strategic Milestones

The PARACRYP roadmap has been strategically segmented into foundational, expansion, and scale phases to reflect the gradual technical evolution, regulatory harmonization, and community growth of the platform. Each phase incorporates modular updates, compliance integration, and market-aligned features that are essential to support tokenized real-world asset ecosystems and privacy-first applications.

2025: Foundation Phase

Q2 2025: Private Testnet Launch

This phase focuses on core infrastructure testing and establishing a robust validator community.

- Launch of closed testnet to a limited validator group (50 nodes), focusing on stress testing the zk-SNARK module.

- Deployment of Oracle API integrations for real-time data streams.

- Implementation of DID (Decentralized Identity) layer with simulated compliance scenarios.

- KYC/KYB compliance sandbox made available to developers and enterprises for prototyping.

Q3 2025: Public Testnet and Cross-Chain Bridge Launch

Public participation is introduced to prepare for decentralization and interoperability.

- Full launch of public testnet with user dashboard and feedback integration tools.

- Bridges to Ethereum and BNB Smart Chain enable preliminary asset transfers

- Validator staking dashboard made public with performance-based metrics

- Early developer tools, test PARA tokens, and explorer analytics go live

Q4 2025: Mainnet Version 1 and Initial Asset Onboarding

Transition to a fully functional network with DAO-enabled governance.

- Launch of Mainnet v1 with complete on-chain governance controls.

- Onboarding of first batch of real-world asset issuers: real estate firms, IP registration services, and tokenized bond platforms.

- Elastic staking pool with real-time validator performance incentives activated.

- Release of Beta privacy wallet with zk-payment functionality and DAO governance controls.

2026: Adoption & Expansion Phase

Q1 2026: Real-World Asset Tokenization Suite

PARACRYP introduces a complete RWA tokenization platform.

- A no-code dashboard allowing real estate agents, businesses, and individuals to tokenize properties and contracts.

- Automated generation of compliance-backed token structures that meet global standards (e.g., SEC Reg-D, VARA licensing).

- Business onboarding toolkit including legal templates, token valuation calculators, and tax integration.

Q2 2026: DAO Governance Expansion + Treasury Activation

Expansion of governance and community-driven funding mechanisms.

- Full deployment of quadratic voting logic to empower smaller holders.

- Community Treasury DAO launched with multi-sig activation and auditing layers.

- Monthly grant rounds begin, allocated through DAO-approved proposals.

- Launch of validator referral and ambassador staking incentive programs.

Q3 2026: Cross-Chain NFT Marketplace and Encrypted Media Layer

Expansion into Web3 creator economy and intellectual property management.

- Rollout of multi-chain NFT exchange supporting encrypted content and private ownership.

- Minting interface for gated NFTs with view-once decryption and creator royalties.

- Support for content licensing, IP notarization, and VR-ready asset linking.

Q4 2026: Developer SDK and Compliance Toolkit Release

Support for institutional partners and developers building atop PARACRYP

- Developer SDK with libraries for token standards, ZK proofs, wallet integrations.

- Compliance suite supporting GDPR, VARA, and FATF rulebook adherence.

- Pilot programs with banks and fintechs integrating PARACRYP APIs into backend systems.

2027–2028: Scale and Global Interoperability

Q1 2027: DePIN Integration and Real-World IoT Tokenization

Supporting decentralized physical infrastructure.

- Integration with DePIN (Decentralized Physical Infrastructure Networks) for smart city, energy, and supply chain projects.

- Tokenized proof of carbon offsetting, energy credits, and logistic milestones.

- Partnering with global IoT device manufacturers for plug-and-play compatibility.

Q2 2027: Regulatory Coverage Expansion

Global harmonization with major jurisdictions.

- Rollout of jurisdiction-specific compliance templates for EU, UAE, Singapore, and UK.

- Launch of “Jurisdiction Select” onboarding portal for tailored token issuance flows.

- Establishment of global legal advisory council to guide DAO compliance upgrades.

Q3 2027: PARA Credit System and Lending Protocols

DeFi-native credit scoring system for individuals and businesses.

- zk-DID-integrated credit scoring engine that aggregates verifiable transaction history without compromising privacy.

- Peer-to-peer and institutional lending pools using tokenized real-world assets as collateral.

- PARA staking multipliers offered for liquidity providers in lending protocols.

Q4 2027+: Web3 Identity and Metaverse Integration

Interoperability with virtual worlds and decentralized social infrastructure.

- Minting of NFT-based identity passports usable in metaverses and gaming platforms.

- Tokenized ownership of virtual land tied to real-world property registries.

- Partnership framework for immersive commerce, education, and telemedicine platforms.

Vision Through 2030

By 2030, PARACRYP will have matured into an institutional-grade asset network that:

- Facilitates $10B+ in tokenized asset value.

- Engages 1M+ monthly active users and 100k+ validators.

- Is fully compliant with legal frameworks across 30+ countries.

- Hosts a thriving developer ecosystem of 10,000+ contributors.

- Enables sovereign-grade privacy, global capital access, and inclusive finance.

GOVERNANCE, COMMUNITY, AND VISION

Decentralized Governance Architecture.

PARACRYP is designed to be governed by its community, validators, and ecosystem stakeholders in a secure, transparent, and programmatic manner. The DAO structure ensures that no single entity controls the future of the protocol, allowing progressive decentralization while safeguarding mission-aligned decisions.

Governance Stack Overview

- Community DAO: Token-based quadratic voting for proposals, upgrades, and treasury use.

- Validator Assembly: Technical council of active nodes responsible for protocol upgrades and security checks.

- Treasury Committee: Budget allocation arm responsible for milestone-based disbursement of DAO funds.

- Compliance Oversight Board: Independent legal advisory panel ensuring alignment with global laws and best practices.

Proposal Lifecycle & Decision-Making Process

1. Proposal Submission: Any token holder or verified developer can submit a proposal.

2. Community Discussion: Public debate on forum and snapshot voting.

3. Temperature Check: Informal vote to determine interest level.

4. Quorum Vote: Formal on-chain vote requiring quorum thresholds and supermajority (if applicable).

5. Execution: Multi-sig controlled upgrade or automated DAO script execution.

Community-Led Growth Programs

1. Global Ambassadors:

- Regional leaders representing PARACRYP across 50+ countries.

- Conduct local meetups, educational content creation, and onboarding campaigns.

2. Developer Engagement:

- Seasonal hackathons with PARA prize pools and mentorship.

- Gitcoin-style bounty system for fixing bugs or building features.

3. Content & Education Guilds:

- Onboarding influencers, meme creators, and educators.

- Ecosystem-wide rewards for viral growth, high-engagement content, or curriculum development.

4. Grant System:

- Up to 5% of PARA reserved for non-profit and mission-aligned development.

- Transparent grant leaderboard and milestone-tracked disbursement process.

5. DAO Reputation System (2028):

- Community members earn non-transferable reputation tokens based on contributions.

- Used as weight in non-monetary governance (moderation, advisory roles).

Partnership Ecosystem Expansion

- RWA Onboarding Alliances: Strategic partnerships with tokenization firms, asset originators, and compliance service providers.

- DeFi & NFT Integrations: Ongoing collaborations with decentralized exchanges, yield protocols, and NFT marketplaces.

- Corporate Blockchain Adoption: SDK licensing and consulting for legacy firms tokenizing their operations.

Long-Term Vision Statement

PARACRYP's ultimate mission is to be the foundational infrastructure for:

- A global privacy-first financial network.

- Decentralized asset ownership and programmable compliance.

- Equitable access to capital, identity, and innovation.

Impact by 2030:

- $10B+ in tokenized assets live on-chain.

- 250+ major institutions actively participating.

- 100,000 validators running nodes worldwide.

- 30+ national regulatory endorsements.

- A fully autonomous, self-improving ecosystem driven by a global community.

With a strong foundation, transparent governance, and a thriving ecosystem, PARACRYP is not just enabling blockchain-based transformation—it is defining the infrastructure layer for the future of tokenized economies, compliant innovation, and data sovereignty

CLOSING & CONCLUSION

Final Thoughts PARACRYP

is not merely a response to the deficiencies of existing blockchain networks—it is a transformative vision for the future of asset ownership, digital privacy, and financial inclusion. Through the convergence of zero-knowledge technologies, real-world asset tokenization, modular compliance architecture, and a community-first governance model, PARACRYP is poised to become the foundational infrastructure for the decentralized economy.

As the global demand for privacy, sovereignty, and decentralized control intensifies, PARACRYP offers an adaptable and future-proof architecture capable of meeting these needs. Its layered design enables the smooth fusion of digital and physical economies, ensuring value transfer is borderless, compliant, and trustminimized. This innovation goes beyond digital convenience—it's about creating a universally accessible system where individuals, enterprises, and institutions can operate securely and transparently.

Why PARACRYP Matters Now

We are entering a decade where trillions of dollars in assets will become digital, programmable, and tokenized. From real estate and carbon credits to intellectual property and government bonds, the entire structure of ownership and value exchange is undergoing an irreversible transformation. PARACRYP positions itself as a catalyst for this shift—not only by supporting this tokenization but by ensuring it is carried out ethically, efficiently, and privately.

Invitation to Participate

The PARACRYP ecosystem is open and evolving. Whether you're a developer, institutional partner, policymaker, or everyday user, there is a role for you to play in shaping this vision. We invite builders to develop on our protocol, creators to protect their digital work, asset holders to tokenize value with privacy, and communities to govern their own financial systems.

Our journey is just beginning—but we believe the foundation we are laying today will support the decentralized cities, platforms, and economies of tomorrow. In Unity, Privacy, and Trust — We Build PARACRYP.

Contact & Resources

- Email: mm@paracryp.com

- Website: www.paracryp.com

- Developer Hub: dev.paracryp.com

- DAO Portal: dao.paracryp.com

- Whitepaper Repository: docs.paracryp.org

- Social Media: @paracryp on X, Telegram, Discord

Let us create the infrastructure that serves people, not platforms. Let us reclaim ownership of data, identity, and capital.

PARACRYP, let us build together.